“If you know your enemy and know yourself, you need not fear the result of a hundred battles”

– Sun Tzu from The Art of War

In recent months, we have shared articles that help you to understand yourself, your organisation and its market position with tools like SWOT and SOAR and Understanding your context.

As the great Sun Tzu has pointed out, it is also important to know your enemy, or – for many not for profits – who you are competing against. That is, the other organisations who are working in similar locations and providing similar or alternative services.

While some organisations may have a better understanding of competing against other providers for fee for service income (e.g. NDIS and aged care), you are also competing for funders and donors, volunteers and employees. A local cricket club might not only be competing for the most talented players against the cricket club two suburbs over, but the local surf lifesaving club is also competing for the same young people to attract to their sport.

Have you ever wondered why it is that one of your competitors is growing at a rate that is faster than you? Ever thought about what they are doing well that you aren’t?

Sometimes your organisation will notice a new niche or change in the market and other times a competitor will notice it before you do. Monitoring your competitors in the market is one way to pick up on these shifts.

It’s possible to prepare a competitor analysis fairly quickly by looking at the top organisations that are similar to yours. We’ve included a model and example below to help you do just this.

Industry context is important in considering how many competitors you would include in this analysis but three to five is usually a good number to look at. To keep the analysis simple, the competitors might be put into groups if they have similar attributes.

Undertaking the analysis involves looking at the services the other providers deliver to people similar to your customers. What do they do better than you? Do they have better systems, marketing or key people? What makes them unique? What are their marketing tactics and results? What are their social media presence and metrics? You could even go so far as to look at a SWOT analysis on their business.

It can be useful to look at size as part of the competitor analysis, as size can impact culture and become a point of difference. For example, smaller organisations can feel more personable and customers can access the CEO or senior leaders, as compared with stereotypes associated with a big service provider that is managed from interstate.

In completing the competitor analysis, note that information about some services can be harder to find than others – e.g. accommodation providers often don’t list where their accommodation is, for reasons of client confidentiality.

You might have staff who used to work elsewhere who can provide insights to competitors or look up information online.

For disability services providers, data from the NDIS quarterly reports can be used to compare the number of providers and size of client group as this will provide an indicator of where the market gaps are, and what areas are well served.

Once you have built up an understanding of what your competitors are doing, you need to think about what to do with that information! It’s not about copying them, but you want to know what you do differently and how you compare.

It could be useful to think about what you would say in response to a question from a person with disability considering coming to you for services: “why would I come to you instead of ABC down the road?”

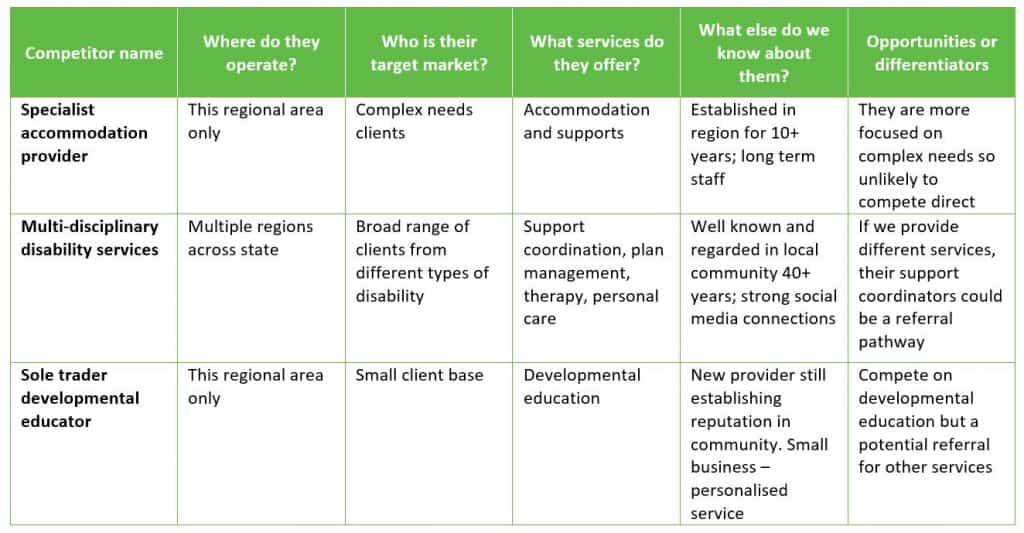

It is important to translate this knowledge into tangible actions that adjust how you respond. That doesn’t mean copying the competitor. Some people tend to rush out to match what the competitor offers, but it’s best to find the point of difference that appeals to your target market. It might be that your analysis reinforces what is unique and special about the service you provide, and you want to reinforce that. Below is a sample competitor analysis matrix of an established mid-size city-based disability provider that is looking to move in to a new regional area. They want to deliver services such as behaviour support, developmental education and potentially accommodation.

They might have three different competitors in the regional area, being a specialist accommodation provider, multi-disciplinary disability services organisation and a sole trader developmental educator.

Referring to another organisation as a ‘competitor’ may be a bit too simplistic – it may well be that their services are complementary and that your niche is slightly different. In this case, it could be that you could receive referrals from the support coordination practice but that they might not want to build up a new competitor in areas where you do compete.

In the example below, you can see areas where our organisation might compete versus complement.

To make the learnings from this article more real, why not take 15 minutes and have a think about your competitors now. Perhaps you could pick up a pen and paper and put the headings of this model across a page or open up a Word document and create a table? Then take some time to write some points about your key competitors and how to position your value proposition to be unique.