The process

We invited 30 software vendors that we consider to be offering NDIS-ready products to participate in a detailed self-assessment of functionality and other criteria, including security and support.

In total, 20 vendors agreed to supply detailed responses to more than 200 separate criteria.

The list of participating vendors can be found at Appendix 1.

It was beyond the scope of this exercise to provide a comprehensive, controlled evaluation and test of each product e.g a Choice-style review.

Steps in our process

The 200 criteria were developed collaboratively with a group of NDIS providers. The group includes a wide range of providers – service type, size/scale, geographic reach, maturity, IT/data sophistication – that we think generally reflects the national not for profit NDIS provider economy. The members of the user/testing group are listed at Appendix 2.

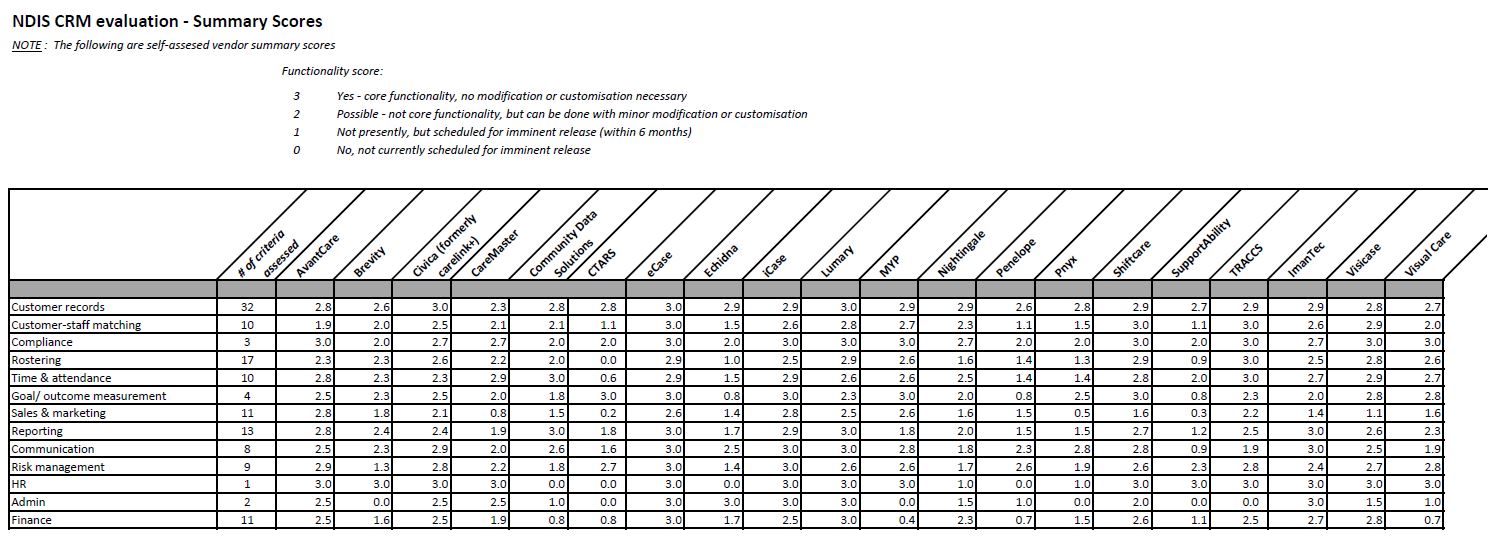

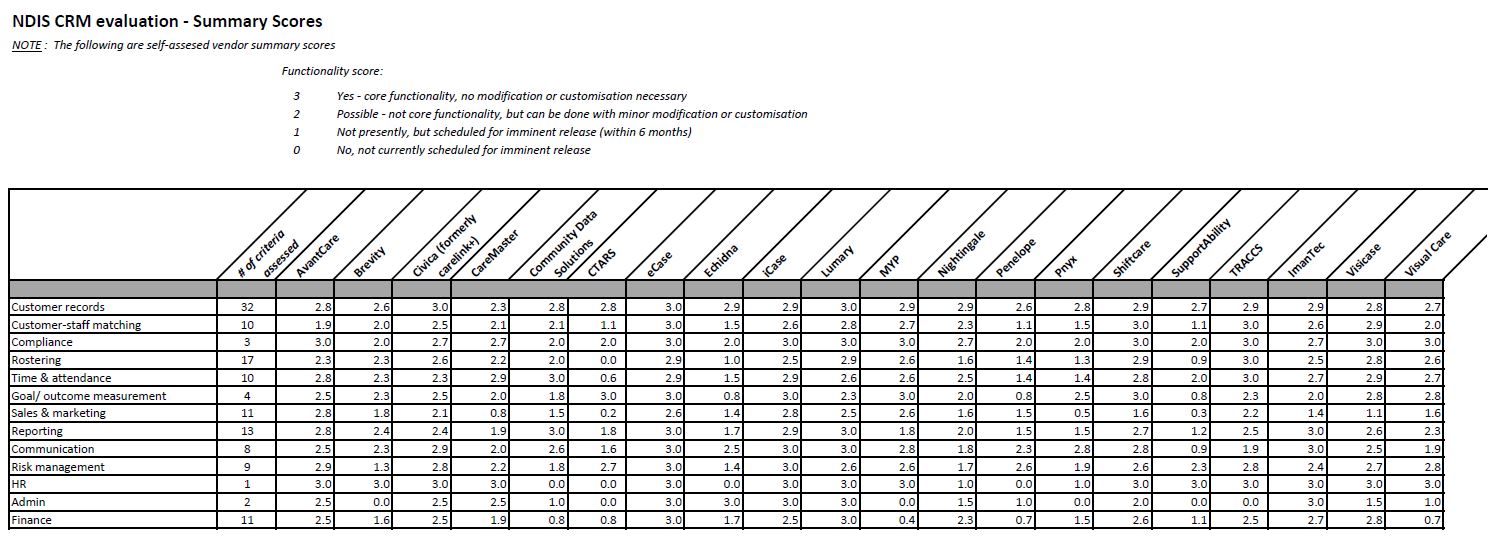

Approximately half of the criteria required vendors to self-assess the degree to which their product meets the criteria, nominating a ‘score’ using the following guide:

3 Yes – core functionality, no modification or customisation necessary

2 Possible – not core functionality, but can be done with minor modification or customisation

1 Not presently, but scheduled for imminent release (within 6 months)

0 No, not currently scheduled for imminent release

The other half of the criteria required a written response.

Vendors were offered the opportunity to present an online demo of their product to the user/testing group.

As a final step in the process, CBB contacted at least one and in some cases two referees for each of the 20 vendors. During this reference-checking exercise, we noted a high degree of variability in the IT/database skills and experience of some referees and consequently made a decision not to publish referee responses. CBB recommends that you speak with at least two referees, who have similar requirements to you, before signing a contract with any software vendor.

What did we find?

No single product will meet 100% of your organisation’s needs. Choosing to go down the path of a single point of truth database in this rapidly evolving NDIS economy will inevitably involve some compromises, including acceptance that you may need to modify or let go of some of your existing organisational processes.

Some vendors are investing heavily in development of their product and will quickly deliver upgraded functionality that matches emerging NDIS policy or process (e.g. NDIS portal) changes.

How to benefit from the work we have done

For any NDIS provider looking to either implement a CRM/database solution for the first time, or upgrade to a new one, we have compiled a list of a top 20 tips for how to approach the exercise; see Appendix 3.

We haven’t validated the responses from each of the vendors. We recommend that you thoroughly check any product claims before selecting a product.

Exercise caution in interpreting the results

Caution should be exercised in interpreting the information presented at Appendix 4 (averaged vendor self-assessed scores) because:

All vendors self-assessed their products against the criteria that we presented to them. It was beyond the scope of this exercise to verify the veracity of vendor claims.

The criteria and average scores may or may not be relevant to your organisation, depending on your size, scale, market cohort/s, service range etc. For example, if the majority of your organisation’s revenue comes from outside NDIS (e.g. out of home care for at risk children, aged care), you may have other more appropriate evaluation criteria.

Vendors may deem that their product meets a criteria, but whether or it not it meets the requirement in an intuitive and efficient way was beyond the scope of this comparison exercise.

Some of the newer products in the market are undergoing very rapid development and enhancements to functionality are being released frequently. Therefore, it is possible that the responses in the report for some vendors may already be out of date.

Selecting your CRM

In selecting your CRM you should carry out a detailed process of identifying your requirements, reviewing vendors and their products and checking references. Further guidance is included in the tips in Appendix 3. You may also want to engage an independent consultant to support you through this process. You should also seek references for your consultants and confirm that they are truly independent of any software providers.

Appendix 1: Products that have been evaluated

- AvantCare

- Brevity

- Civica (formerly carelink+)

- CareMaster

- Community Data Solutions

- CTARS

- eCase

- Echidna

- Lumary

- iCase

- MYP

- Nightingale

- Penelope

- Pnyx

- Shiftcare

- Supportability

- TRACCS

- UmanTec

- VisiCase

- Visual Care

Appendix 2: User/testing group members (all SA-based unless otherwise stated)

- Access2Arts

- Accessability (WA)

- Anglicare SA

- Assured Home Care

- Barossa Enterprises

- Cara

- Catherine House Inc

- Centacare SA

- City of Onkaparinga

- City of Salisbury

- Community Living Project Inc

- Community Support Incorporated

- Diamond House

- Far North Community Services (WA)

- Guide Dogs SA/NT

- Hills Community Options

- Holiday Explorers

- InComPro

- Interchange

- Kudos ECEI partner

- PQSA

- Royal Society for the Blind

- SA Care

- SA Support Services

- Tutti Arts

- West Coast Homecare

Appendix 3: Top 20 tips regarding CRM evaluation and implementation in your organisation

If your organisation intends embarking on a project to assess, short-list, choose and implement a CRM/database, here are some tips you may find useful:

- Unless you are a very small provider or a start-up, implementation of a contemporary CRM/database is no easy job and will be one of the most challenging change management projects you are likely to encounter. Be realistic about the time you will need to spend to transition from your old system to the new database/CRM. The more time you spend preparing, the less likely that something critical will be missed. You can’t simply purchase an off the shelf product, plug it in and magically have a working performance dashboard and improved profitability. A system implementation of this magnitude requires a significant effort on your part as well as the vendor’s, so make sure you choose a vendor with values that match your own.

- Be clear on what you are trying to achieve – is it back-office efficiency (including rostering) and a fully paperless environment, customer pipeline management, better customer/staff matching, customer outcomes measurement, visibility of key data to customers, increased utilisation for frontline staff, compliance with legislative obligations etc. Your agreed purpose and vision will also help you when assessing vendor products for suitability.

- Before you write up your requirement specification and articulate mandatory criteria, sign up for as many free product demos as you can, and include at least a couple of frontline workers in the demos. It’s one thing to choose a product that works for team leaders and management, but it’s arguably more important to choose a product that frontline workers will find easy to use, as this will aid the change management process.

- Where possible, focus on the outcome required for each of your mandatory criteria, and don’t stipulate a detailed process just because that’s the way you currently do things. A software vendor may have a much better solution to achieving any given outcome, which, could in the long term, save you time and money.

- Ask your short-listed vendors to submit a written response against a written list of requirements, scoring themselves using a very clear scoring criteria. Review vendor responses critically by questioning anything that is unclear and asking for more information if the response is inadequate.

- If you don’t have an in-house CIO, IT Manager or Business Analyst, bring specialist/s in on a temporary basis to manage the requirement articulation, product selection and implementation. You may wish to consider checking whether they are completely independent as some consultants may benefit financially or otherwise from recommending a particular product/solution.

- Assess the pros/cons of adopting the product’s standard functionality, which may involve amending your existing business procedures to fit. Try to avoid extensive configuration and customisation where it isn’t going to add value to your customers. This can affect future product updates, complicate any future changes and will add to your ongoing costs.

- Document any system interdependencies so that the vendor is made aware of other in-house systems that will need to interface (talk/API) to the new CRM system e.g. the finance/billing system. Check that the interface build will be part of the solution implementation.

- Prepare a detailed project implementation plan prior to signing a contract with the vendor, so that both parties are agreed on the steps and timeframes and also who is responsible for what.

- Make sure your implementation plan includes testing the new CRM against requirements as specified to the vendor. Also make sure that your contract is clear on who will pay for bug fixes, during the testing phase, in the period post implementation and in the longer term.

- Make sure you cleanse historical data before transferring to the new database. Ensure your implementation plan includes checking of the data post transfer to ensure that it has been transferred correctly and that records have not been corrupted.

- Include a back-out strategy in your implementation plan, to be used in the event that the implementation does not go smoothly and you need to revert to the old CRM. Make this the responsibility of the vendor so that they can prepare accordingly.

- Ensure your implementation plan includes a provision for some post implementation support, so that the vendor is aware they will need to be promptly available should any problems arise.

- Involve your staff (the CRM users) when documenting your requirements for the new CRM. Staff should also be involved in the testing process, as they can easily identify what is not working, or missing, which is likely to cause workers to avoid using the product. If the budget allows, consider having onsite support for the first couple of days post implementation, for prompt attention to any issues that may arise, as well as user support.

- Assess hardware requirements including portable devices and server capacity.

- Provide comprehensive training for frontline staff to ensure that they optimise functionality of the new product and don’t under-estimate the magnitude of the change management aspect.

- Provide training for management to ensure they understand how to use reports and performance dashboard metrics.

- Train/educate customers to ensure that they get maximum value from the customer portal (if your organisation has decided to give customers visibility to selected data).

- Ask the vendor for referees, being NDIS providers that have undergone a very recent implementation. You should aim to talk to referees who know NDIS inside-out. Talk to providers that are using the product that weren’t put forward as referees. Salespeople won’t introduce you to someone that has had a troubled experience with implementation or use of their product, but you may learn a lot from a quick chat with such organisations. When you talk to referees, some of the questions you may like to ask include:

- What product/s were you using previously and why did you decide to change?

- How many products did you assess?

- Why did you choose this product, and which products ranked second and third on your list?

- What are the three biggest issues you experienced during implementation and if you could do something differently, what would it be?

- Have you surveyed frontline staff and customers as to whether they like the product? If not, what feedback have you had in relation to usability

- Ask vendors the question, “When next we meet face to face, can you please show me a copy of your product development road map?” (Note: most vendors won’t give you a copy of this commercial-in-confidence information, but shouldn’t have any issue in showing it to you face to face). In addition, ask them to give you examples of recent upgrades following NDIS changes, including the dates that those upgrades went live – this will give you an indication of the vendor’s responsiveness to remaining ‘NDIS-compliant’.

Appendix 4: Summary of self-assessment scores

The scores below are self-assessment scores that were provided by vendors and have not been independently verified. Refer to the section above ‘Exercise caution in interpreting the results’ for further context.