Language Disorder Australia is always looking for ways to provide great employee benefits to all staff. As an employee, one of the benefits you can access is salary packaging, but there is a lot more to explore with CBB.

What would you do with a 6-12% increase in your take-home pay?

Could you pay off your mortgage earlier? Would you finally upgrade your car or even your TV? Or could you just breathe easier knowing you have extra money for life’s emergencies?

If you’re ready to get started, you can book a sign-up appointment with a member of our team. Otherwise, watch the video below or keep reading to find out more about the benefits of salary packaging with CBB.

Video link: https://youtu.be/So1F9vOxO6A.

Presented by CBB’s SA State Relationship Manager, Mark Gauci.

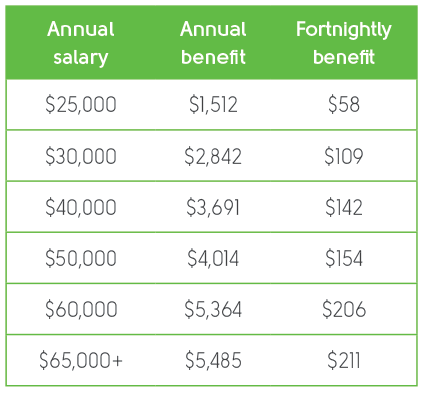

How much extra take home pay will you get?

You could salary package a maximum of $15,899 tax free each FBT year. Your exact additional take home pay will depend on your annual salary. This table shows the indicative financial benefits for different salaries. Discover how much extra you could take home, by using our calculator.

Please note that we provide a tailored and highly detailed analysis of your benefit at your sign-up appointment.

What can I spend my money on?

Your salary packaged funds can be used to take care of regular payments such as: mortgage and rent payments, personal loan repayments, and even bills and utilities. Any routine payment that can be paid electronically (and you have acceptable proof of debt for) can usually be set up through CBB.

You can also choose to load your funds onto a CBB Salary Packaging Card, which can be used to pay for groceries, petrol, and other household goods with tax free dollars. Just imagine how much money you could save on everyday essentials.

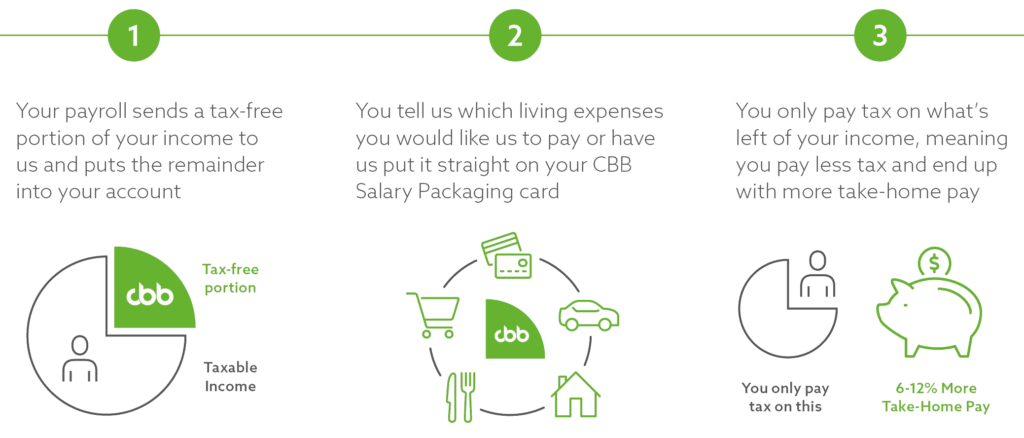

Want to know how it all works?

Our friendly salary packaging team take care of the process for you, leaving you free to enjoy the benefits. Here’s how we make it happen:

If you have Child Support, student debt, or Centrelink payments you can read more about how salary packaging affects your Assessable Income and Adjusted Taxable Income.

Already salary packaging with us?

If you want to make a change to your salary packaging arrangements, please visit the Manage your account page on our website. Alternatively, you can email your enquiry to [email protected] or call our friendly Customer Care team on 1300 763 505 Monday to Friday from 8.30am to 6.30pm (Adelaide time).

Adelaide-based personalised service when you need it

Adelaide-based personalised service when you need it Novated leasing

Novated leasing Tax-free dining out and accommodation

Tax-free dining out and accommodation Electronic device packaging

Electronic device packaging Real banking rewards with Beyond Bank

Real banking rewards with Beyond Bank Better Health with Medibank

Better Health with Medibank