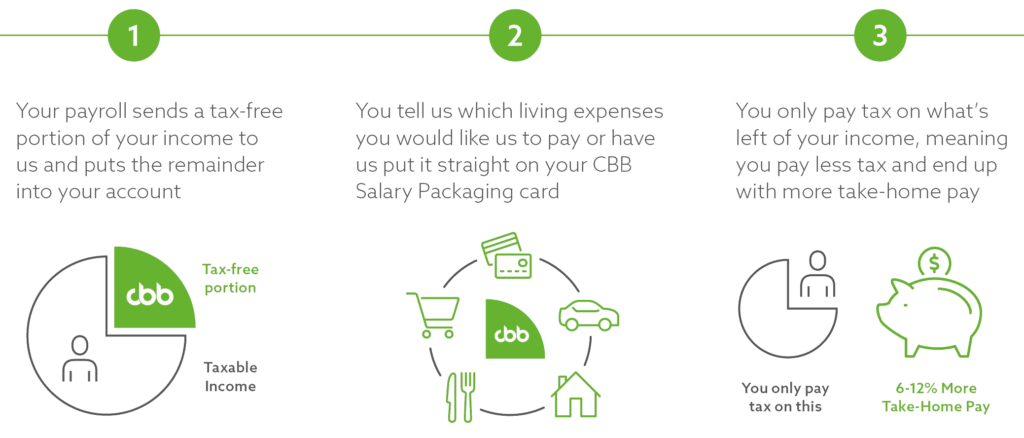

Could you pay off your mortgage earlier? Would you finally upgrade your car, or even your TV? Or could you just breathe easier knowing you have extra money for life’s emergencies?

If your employer offers salary packaging through CBB and you’re ready to get started, you can book a sign-up appointment with a member of our team. Otherwise, keep reading to find out more about the benefits of salary packaging with CBB.